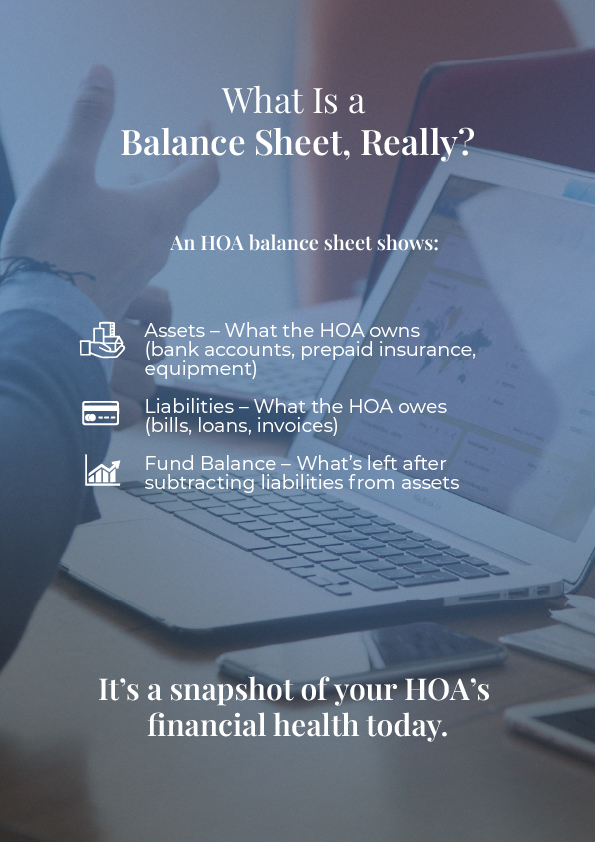

What Is a Balance Sheet, Really?

A balance sheet shows where your HOA stands right now. It’s a snapshot of what the association owns, what it owes, and what’s left over. That last part, the fund balance, is the cushion your board relies on to keep things running.

Every HOA should have three key financial reports. The balance sheet is one of them. It gives you a clear picture of your financial health today.

It breaks into three simple parts:

Assets are what the HOA owns. Think bank accounts, prepaid insurance, and equipment.

Liabilities are what the HOA owes. That includes unpaid bills, loans or contractor invoices.

Fund balance is what’s left when you subtract liabilities from assets. It reflects how much money is available to meet future expenses.

The HOA Twist – Why Balance Sheets Look Different

HOA balance sheets don’t follow the same rules as business ones. They use the same structure with assets, liabilities, and fund balance, but some line items work a little differently.

For example, most HOAs split money into two buckets: operating funds and reserve funds. Operating funds pay for daily costs like landscaping or water. Reserve funds sit in savings and cover big repairs like roofs or roadwork.A healthy reserve fund can make a big difference when large costs come up.

You might also see prepaid assessments. That means owners have already paid for future months. It counts as an asset for the HOA, but also shows up as a liability because the money technically hasn’t been earned yet.

Then there are delinquent dues, which appear as assets even if they may never be collected. Fixed assets, such as a clubhouse or pool, are often left off after the first year.

It works best when you can read it well and keep asking the right questions.

How to Build an HOA Balance Sheet

Building your HOA’s balance sheet doesn’t require an accounting degree. If you’ve got access to your financial records, you can pull this together in one focused session. Work through the steps and you’ll see what’s going on

Step 1 – List your assets

Start by listing everything the HOA currently owns or is owed. These go in the “Assets” section.

Look for:

- Bank accounts – Your current operating and reserve account balances

- Investments – Money earning interest

- Prepaid expenses – Bills paid early for future services

- Assessments receivable – Dues that homeowners owe but haven’t paid yet

Make sure you separate operating assets from reserve assets. You’ll want to track those buckets independently.

Step 2 – Add up your liabilities

Next, list everything the HOA currently owes. This is your “Liabilities” section.

Include:

- Unpaid invoices – Bills you’ve received but haven’t paid yet

- Loans – Any money the HOA has borrowed

- Prepaid dues – Dues homeowners paid in advance for future months

- Payroll – If your HOA has staff, include any outstanding wages or taxes

Review your accounts payable and contracts to catch anything still unpaid.

Step 3 – Calculate the fund balance

Now subtract your total liabilities from your total assets. That number is your fund balance.

Formula:

Assets – Liabilities = Fund Balance

Your fund balance reflects what’s left. It can be positive or negative.

- Operating fund balance – Used for regular expenses like utilities and vendors

- Reserve fund balance – Saved for big-ticket items like roofs or repaving

Software can handle the math, though it still pays to check it yourself. A clear balance sheet gives the board control and cuts surprises.

And yes, things don’t have to be perfect. Keep doing this and use the numbers to guide good choices.